Rental Property Damage - Who’s Responsible for the Repairs and Costs?

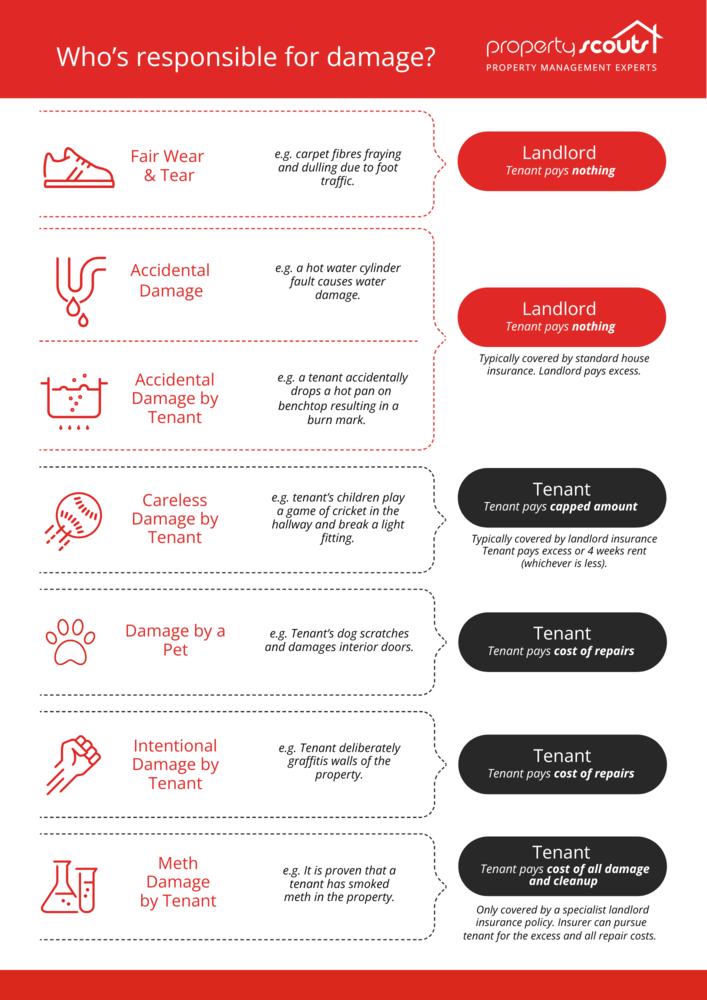

From faded curtains to wine stains on the carpet, suspicious holes to meth contamination, there are a number of different ways to categorise rental property damage.

Below, we summarise the different types of rental property damage, including what damages landlords and tenants are responsible for, and who is responsible for covering the cost of repairs.

We’ve also included a FREE rental property damage cheat sheet so you can compare the types of damage side by side.

Fair Wear and Tear

Have you noticed dull spots in the carpet of your rental property? Are the curtains starting to fade? Perhaps a few doorknobs are coming loose or the favoured element on the stove is looking a bit tired? All of the above are examples of fair wear and tear. Fair wear and tear is defined by Tenancy Services as “the gradual deterioration of things that are used regularly in a property when people live in it, provided they are used normally.” This includes chattels such as washing machines provided by the landlord.

Who is responsible for covering the cost of repairing fair wear and tear?

If damage occurs as a result of normal use, the landlord is responsible for covering the cost of repairs. If in doubt, the landlord must prove that the damage is not fair wear and tear.

Accidental Damage (Not Caused by Tenant)

Accidental damage encompasses damage that is beyond a tenant’s control. The likes of a faulty hot water cylinder that results in water damage, a shattered window or broken lock caused by a burglar breaking and entering, and various damages arising from natural disasters all fall under the category of ‘accidental damage’.

Who is responsible for covering the cost of repairing accidental damage?

As per Tenancy Services, tenants are not responsible for repairs or damage arising from burglaries, or natural disasters (such as severe weather events, floods and earthquakes). The cost of these repairs are typically covered by standard house insurance and the excess is paid by the landlord.

It is important to note, however, that a landlord's insurance policy will not cover their tenants’ personal belongings. This is one of the reasons we highly recommend tenants take out their own contents insurance policies - it's better to be safe than sorry!

Accidental Damage by Tenant

You’ve come home from a long day at work and you’re bustling around in the kitchen preparing dinner. In the heat of the moment, you drop a hot pan on the benchtop or the hot lasagna dish on the floor, leaving an unsightly burn mark. We’ve all been there. This is an example of accidental damage caused by the tenant.

Who is responsible for covering the cost of repairing accidental damage?

In instances where damage was accidental and not intentional, the cost of repairs will likely be covered by the landlord’s insurance and the tenant will not be held liable for any costs associated with the accidental damage. In some cases, the landlord may argue carelessness (particularly if burn marks or carpet stains are a regular occurrence rather than a one-off). To absolve oneself of liability, the tenant must prove that the damage was neither careless nor intentional.

Landlords please note that in accordance with Section 49D of the Residential Tenancies Act 1986, by law, you cannot demand, request, or accept from the tenant any offers to pay the insurance excess or cover the costs associated with repairs that exceed the tenant’s liability in accordance with section 49B.

Careless Damage by Tenant

It’s a right of passage as a child to play cricket in the hallway with your siblings when your parents aren’t looking. Unfortunately, if your child’s cricket game results in a broken light fitting, or they have kept score using crayons on a wall, it’s more than likely the damage will be deemed as careless due to negligence. Other examples of careless damage include (but are not limited to) cigarette burns, fires started by leaving the stove unattended, stains and odours caused by pets, ripped carpets, or any other damage caused by obvious misuse or lack of attentiveness.

Who is responsible for covering the cost of repairing careless damage?

Like with accidental damage and fair wear and tear, careless damage is typically covered by the landlord’s insurance. However, due to the nature of the damage and provided it is proven to be caused by the carelessness of the tenant, or a person whose actions the tenant is responsible for, the tenant will be liable to pay the insurance excess or 4 weeks’ rent (whichever is less).

It’s important to note, that a landlord’s claim to excess can be dictated by their individual insurance policies. If there are multiple incidents of careless damage (for example, multiple large stains across separate rooms), the landlord may be able to claim insurance for each incident - meaning there are multiple excess payments due that may exceed 4 weeks’ rent, in which case the tenant may be required to cover the full amount of the aggregated excesses.

Damaged caused by a Pet

If a tenant’s pet causes damage to a rental property - such as scratching doors, chewing carpets, urinating on flooring, or damaging gardens - this is classified as damage caused by the tenant. A new law (not yet in effect) confirms that tenants are responsible for covering the cost of any damage caused by their pets, including scratching, chewing, or urinating on surfaces.

Who is responsible for covering the cost of pet damage?

The tenant is liable for the cost of repairs when damage is caused by their pet. This includes both accidental and negligent damage, such as persistent scratching, chewing, or soiling of surfaces. The responsibility lies with the tenant even if the damage was not deliberate, as the pet is considered to be under the tenant’s control.

To hold a tenant liable for pet damage, the landlord must show that it was caused by the tenant’s pet while the pet was under their care or permitted to be at the property. The standard of proof required is “more likely than not” or “on the balance of probabilities.” This clarification aligns with the principle that tenants must take reasonable steps to prevent avoidable damage during their tenancy.

Intentional Damage by Tenant

If a tenant or a tenant’s guest deliberately graffitis the walls of a rental property this is classed as intentional damage. Intentional damage also extends to the likes of smashing a window to get into the property, kicking holes in walls, and imprisonable offences such as smoking methamphetamine.

Who is responsible for covering the cost of repairing intentional damage?

The tenant is liable for the full cost of repairs when damage is deemed to be intentional or the result of an act or omission that constitutes an imprisonable offence. In the case of imprisonable offences causing damage, it does not matter if the damage wasn’t intentional, the tenant will still be liable for covering the full cost of repairs.

In order to hold a tenant liable for intentional damage the landlord must prove that the alleged damage was committed by the tenant or a person who was on the premises with the tenant's consent. The standard of proof required is described as “more likely than not" or “on the balance of probabilities". If damage is proven to be intentional or the result of a criminal offence, insurance companies can pursue tenants on the landlord’s behalf.

Methamphetamine (“Meth”) Damage by Tenant

Under the Misuse of Drugs Act 1975, using, possessing, selling and manufacturing meth are unlawful offences. If it is proven that a tenant or a tenant’s guest has smoked, sold or manufactured meth in a rental property this is a breach of the RTA and an imprisonable offence. By committing an imprisonable offence tenants who cause meth contamination are also breaching their obligation to not intentionally or carelessly damage the property (Tenancy Services).

Who is responsible for covering the cost of methamphetamine damage & decontamination?

Provided it can be proven that the tenant was responsible for meth-related damage to the rental property, the tenant can be held liable for the cost to repair all damage and decontaminate the property. The average cost of repairing property damage caused by meth is $20,000. In addition to this, the Tenancy Tribunal may order tenants who have used a rental property for an unlawful purpose to pay a penalty of up to $1,000.

Methamphetamine damage is typically covered by insurance policies that will normally require a baseline test and/or testing in between tenancies to be eligible for cover. If the landlord claims insurance for methamphetamine-related damage, the insurer can pursue the tenant for the excess and all repair costs.

What to do if you spot damage in your rental property

Regardless of how damage occurred or who caused it, if something needs to be fixed, tenants must report it to their landlord or property manager as soon as possible. Delaying maintenance and repairs can exacerbate damage and the Residential Tenancies Amendment Act 2019 does not protect tenants who do not report damage promptly - meaning the landlord could subsequently request that tenants cover some of the costs associated with repairs (even if the damage was originally classed as accidental or fair wear and tear).

At Propertyscouts, our property managers know the difference between the various types of damage. If you’re looking for an expert to look after your rental property, get in touch today. We’ll be happy to answer any questions you have or give you a free rental appraisal.

Rental Property Damage Cheat Sheet

.png)

(1).png)